Grow Relationships Across Generations with Financial Education

Grow relationships across generations with financial education that works. Convert today’s family members into tomorrow’s wealth-building clients.

FinTech Breakthrough Award for “Best Financial Education Platform”

Grow the Relationships.

Keep the Assets.

Goalsetter gives advisors a scalable way to stay present between meetings and build long-term loyalty across generations.

1.

Strengthen relationships across the whole family.

2.

Leverage financial education to prompt conversations and open new accounts.

3.

Reinforce your value with topical and personalized education for all ages and stages.

82% of women feel left out of financial conversations.

Be the financial advisor that engages them.

Winning Women and the Next Generation Before They Leave

What's your firm's plan?

Advisors often focus on one relationship while overlooking the next set of decision-makers. Goalsetter transforms fragmented family engagement into a strategic Firm Family Plan that drives continuity and long-term growth.

- Connect beneficiaries to advisors before wealth transfers occur

- Open accounts for the next generation today

- Turn the financial education gap into your firm’s greatest leadership opportunity

- Cement your firm's position as "family first."

Client Engagement,

Reimagined

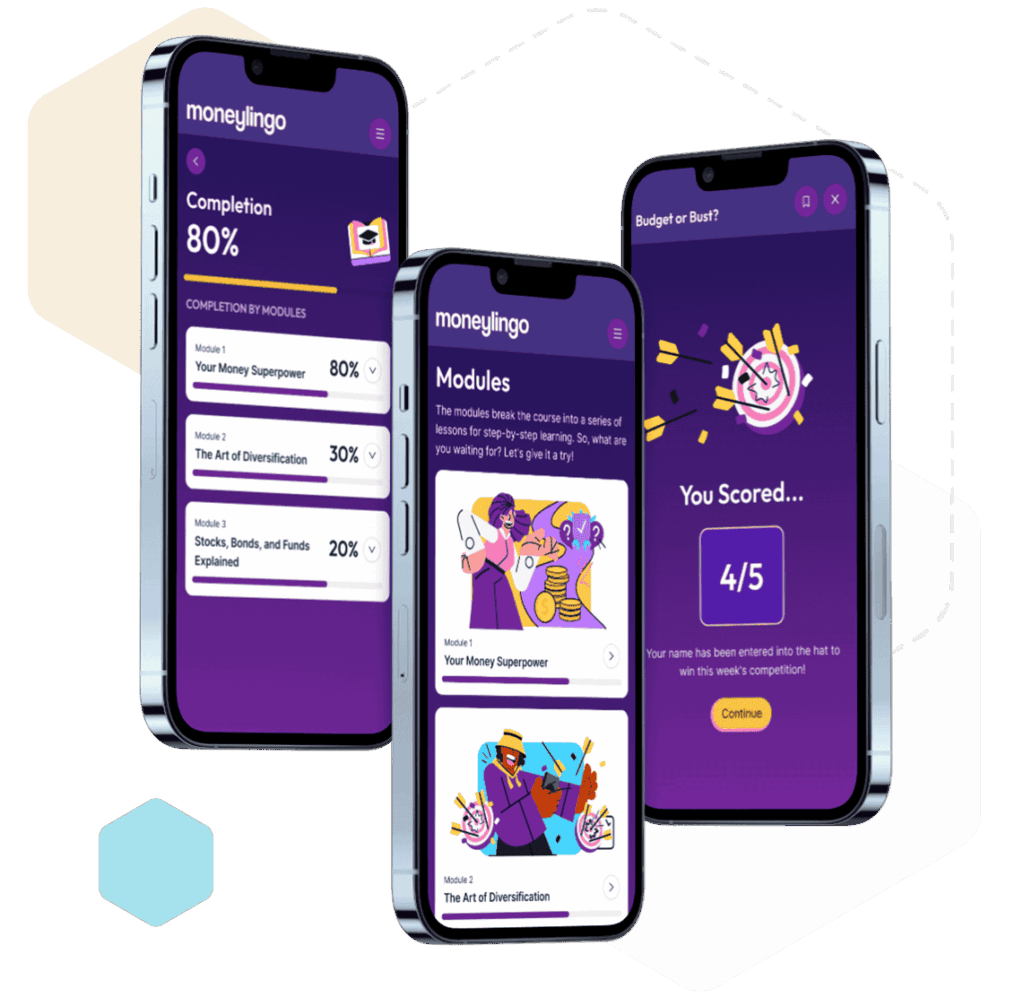

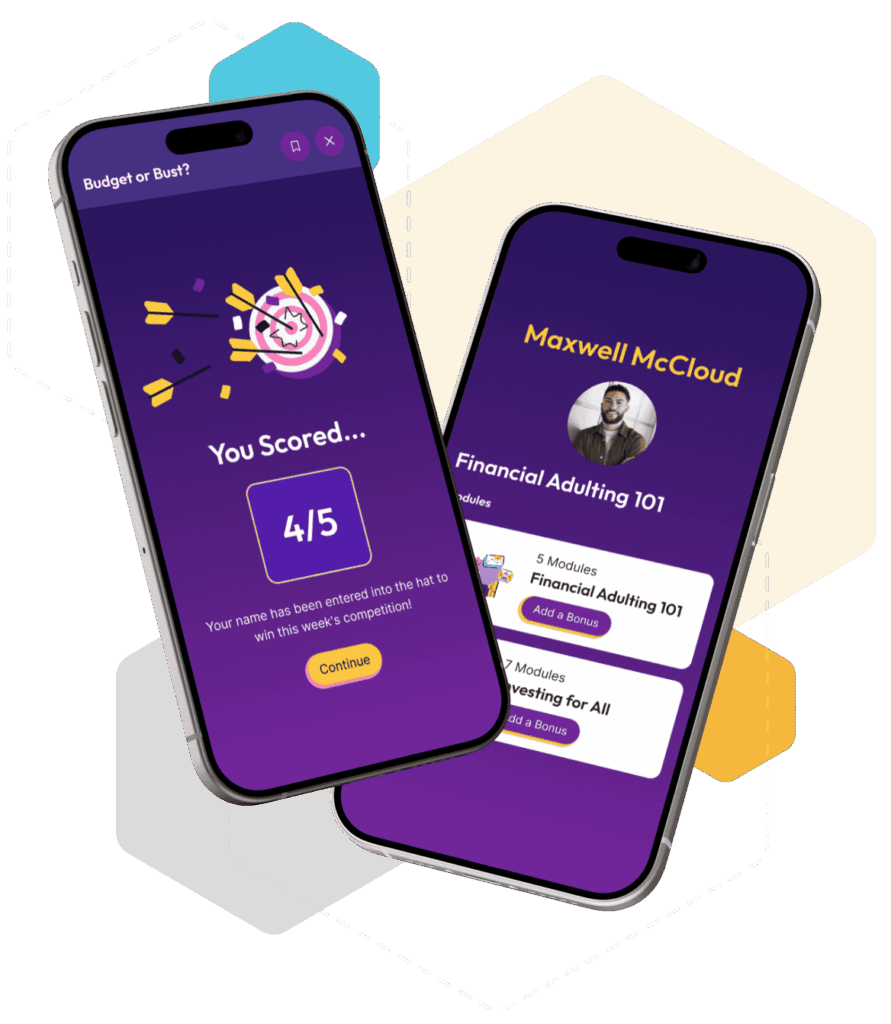

Moneylingo™

A turnkey financial education platform you can offer clients and their families—designed to strengthen relationships, reinforce your expertise, and engage the next generation.

- Short, engaging videos and quizzes covering saving, budgeting, investing, credit, and risk

- More effective than PDFs, newsletters, or one-time workshops

- Reinforces your value between meetings—without adding time to your calendar

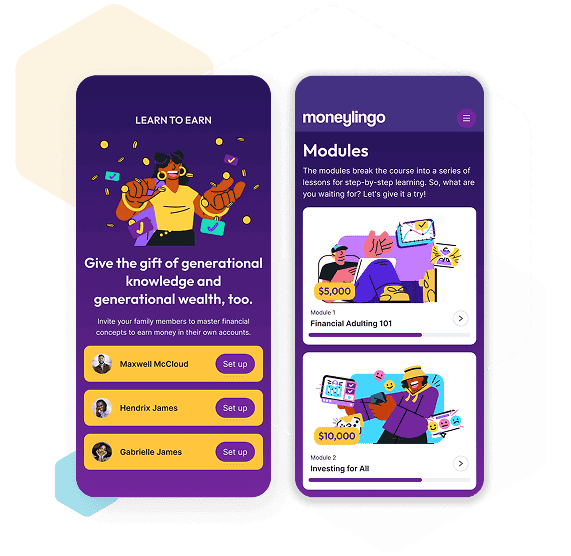

Learn to Earn

Turn financial education into action.

- Incentivize next-generation engagement through reward-based learning

- Guide account-opening journeys in an education-first way

- Create a repeatable engagement system—without increasing advisor workload

What Families Learn and Why It Matters to Your Practice

Actionable lessons that support better decisions today—and a smoother wealth transfer tomorrow.

Students build a real-world understanding of how money works with topics covering earning, spending, saving, and planning, so they can make confident choices instead of guessing. Lessons connect everyday decisions to long-term outcomes through relatable scenarios and practical tools.

Goalsetter makes saving feel achievable by teaching students how to save consistently, set meaningful goals, and understand tradeoffs behind purchases. Interactive challenges help learners build habits and track progress over time.

Students learn how credit cards, loans, interest, and credit scores work, and how borrowing decisions affect future options. Real-world examples help students understand both the benefits and the costs before taking on debt.

Students learn how emergency funds, insurance, and planning can reduce the impact of unexpected financial setbacks. Scenario-based lessons show how preparation improves outcomes when life changes fast.

Students and families build a shared money language that supports clearer discussions about goals, spending, and boundaries. Lessons encourage healthier communication so financial decisions become more consistent and less stressful.