Financial Education

that Actually Works

Goalsetter delivers modern, engaging financial education that turns learning into action. Whether in a classroom, on a campus, or in the workplace, we help people build real financial confidence—and use it.

Built for Every Learning Environment

Goalsetter’s personalized, AI-driven financial education meets learners wherever they are on their financial journey, and takes them where they want to go.

Middle and High School Students

Goalsetter helps K–12 schools meet financial literacy mandates with engaging, standards-aligned lessons that are easy for teachers to deliver and track.

Why it Works

- Fully built, classroom-ready lessons—no DIY or curriculum development required

- Automatic grading and real-time dashboards

- National and state standards aligned, with clear crosswalks for compliance

- Designed for how students actually learn: video, quizzes, games, and discussion

- Works in classrooms, hybrid settings, or 1:1 learning environments

Colleges & Universities

Goalsetter equips college students with practical financial skills to navigate real-world money decisions during and after college.

Why it Works

- Mobile-friendly, self-guided lessons students can access instantly, covering budgeting, credit, investing, and long-term planning.

- Supports student wellness, career readiness, and post-grad outcomes

- Scales easily across across departments and campuses.

- Flexible configuration for general education, first-year experience, or co-curricular use

Goalsetter for the Workplace

Goalsetter helps employers turn complex benefits and financial decisions into clear, engaging learning experiences employees actually understand and use.

Why it Works

- Gamified lessons that guide employees through benefits enrollment and 401(k) selection

- Replaces dense handbooks and PDFs with interactive, easy-to-digest education

- Improves both benefits utilization and employee financial confidence

- Supports financial wellness across income levels and life stages

Goalsetter for Financial Institutions and Advisors

Goalsetter helps financial institutions retain clients, preserve assets across generations, and educate entire families—not just account holders.

Why it Works

- Strengthens client loyalty by offering real financial education that translates to products and services.

- Supports multigenerational wealth transfer by educating both parents and next-generation clients, together.

- Helps retain assets by preparing inheritors to manage money responsibly

- Easily deployed as a family finance benefit for clients at any life stage.

We deliver outcomes

Goalsetter isn’t another content library or DIY curriculum. It’s a proven, turnkey financial education system designed to meet real-world requirements, deliver measurable outcomes, and work seamlessly for classrooms, campuses, workplaces, and financial institutions.

Engaging, Scalable Financial Education

Interactive videos, quizzes, games, and personalized learning paths designed to keep learners engaged and thriving.

Learning journeys built for today’s learning environments

Designed for classroom settings, mobile phones, group instruction, remote learning, and everything in between.

Data-backed results that turn knowledge into behavior

Access real-time data on participation, progress, and outcomes to drive impact and accountability.

Goalsetter’s financial education platform has been proven to help students achieve an average 85% mastery score.

4 out of 5

Save & Invest More

4 out of 5 student learners indicate that they save or invest more because of Goalsetter.

35% of adult learners open a new investment account or financial vehicle based on something they learned on Goalsetter.

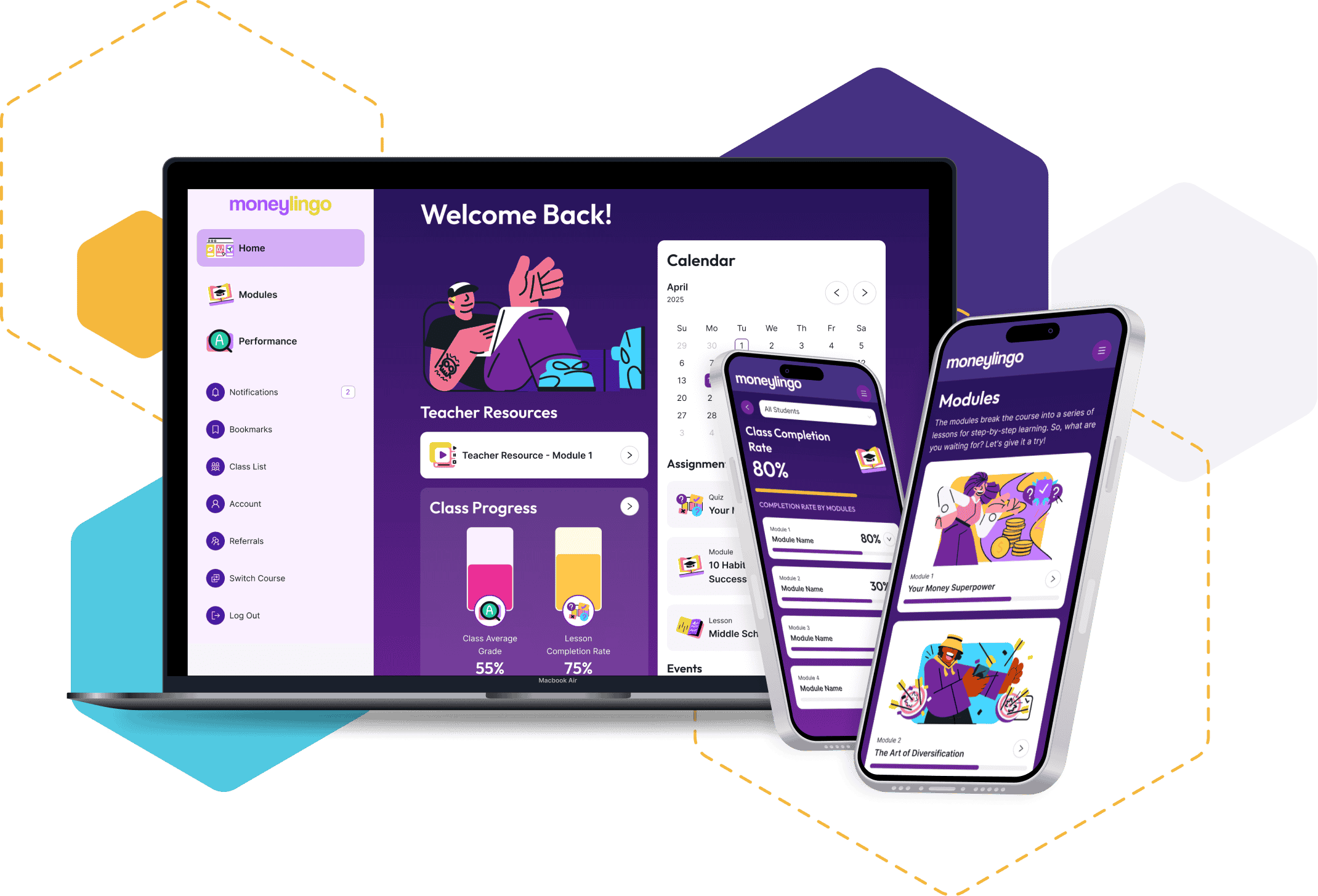

Meet Goalsetter

A complete ecosystem for engaging financial learning.

Choose the platform that best fits your needs, or use both together.

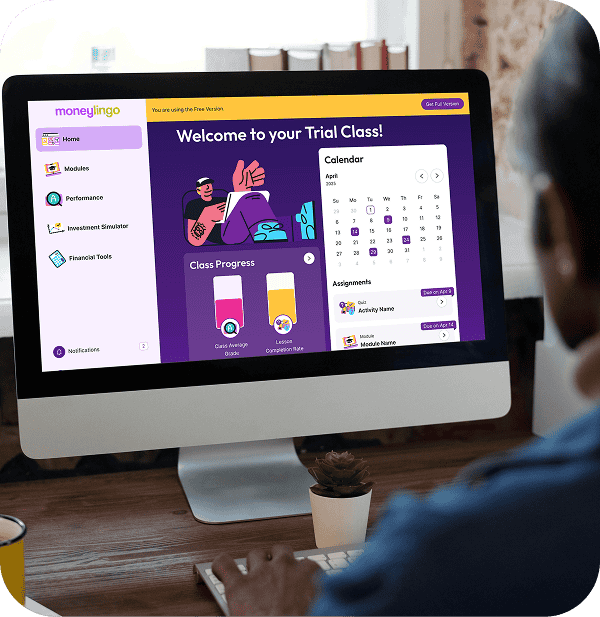

Goalsetter Classroom

Easy for teachers. Engaging for students.

- Assign lessons and track progress in one dashboard

- Automatically grade quizzes and assessments

- Content is aligned with state and national standards

- Customize pacing, content, and delivery models

- Launch in under 6 weeks—no technical setup required

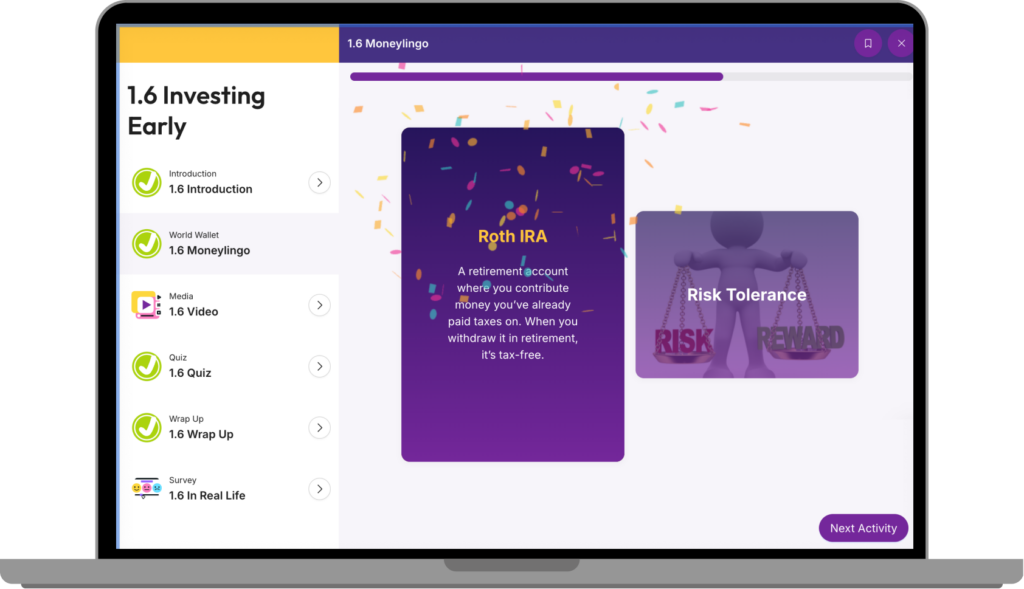

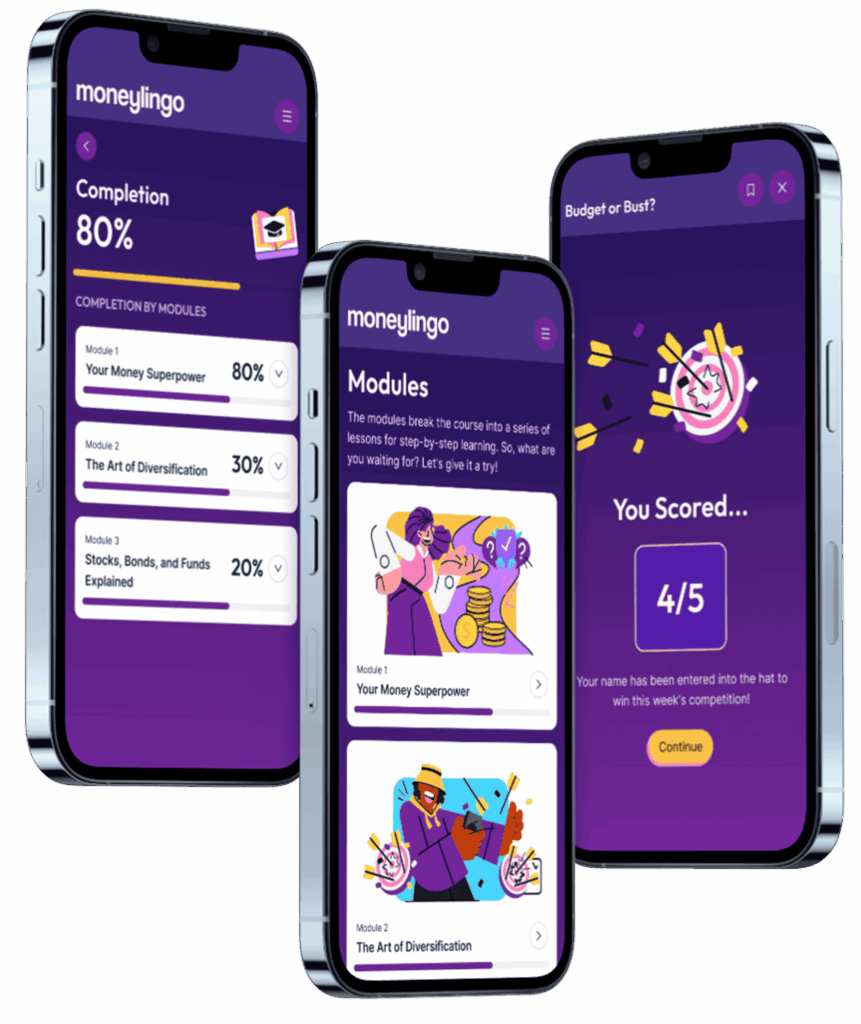

Moneylingo

Mobile Learning. Real Life Lessons.

- A mobile-first financial education experience

- Game based learning turns dense topics into easy learning

- Short, fun, and designed for consistent engagement.

- Covers earning, saving, spending, investing, credit, and risk

- Can be used standalone or inside Goalsetter Classroom

See it in Action

Our award winning curriculum delivers results for learners at every level.

MODULE 1

MANAGING CREDIT – Borrowing Isn’t Free Money

MODULE 2

MANAGING RISK – Protect the Bag

MODULE 3

SAVING – Make Your Money Move (Without Spending It)

MODULE 4

EARNING INCOME – Money Follows Skills

MODULE 5

SPENDING – Know the Game Before You Play It

MODULE 6

Investing - Make Your Money Work Harder Than You Do

Real people.

Real Impact.

Goalsetter drives measurable knowledge gains and measurable outcomes too.

Because financial education only matters if it works.

Featured On

Does not represent an endorsement of Goalsetter or its products or services.

All logos are the intellectual property of their respective trademark holders.

Frequently Asked Questions

Yes—K–12 schools and colleges can sign up for free access to a limited set of full lessons (not a demo).