Cultivate your next generation of customers with Goalsetter.

Leading banks and credit unions across the country are engaging and exciting next-gen clients with our award winning platform.1

FinTech Breakthrough Award for “Best Financial Education Platform”

79% of parents want help teaching their kids financial education.

Goalsetter’s education-first family banking platform7. lets your financial institution give families the support they’re looking for.

Not just another debit card2 . The debit card with financial education attached.

LEARN BEFORE

YOU BURN

A program that turns kids into savers, investors, and future customers.

Our Solution for

Banks and Credit Unions:

When Goalsetter partners with your financial institution, we don’t just provide a youth banking solution.

We offer our partners a holistic financial education and empowerment platform that covers the whole family.

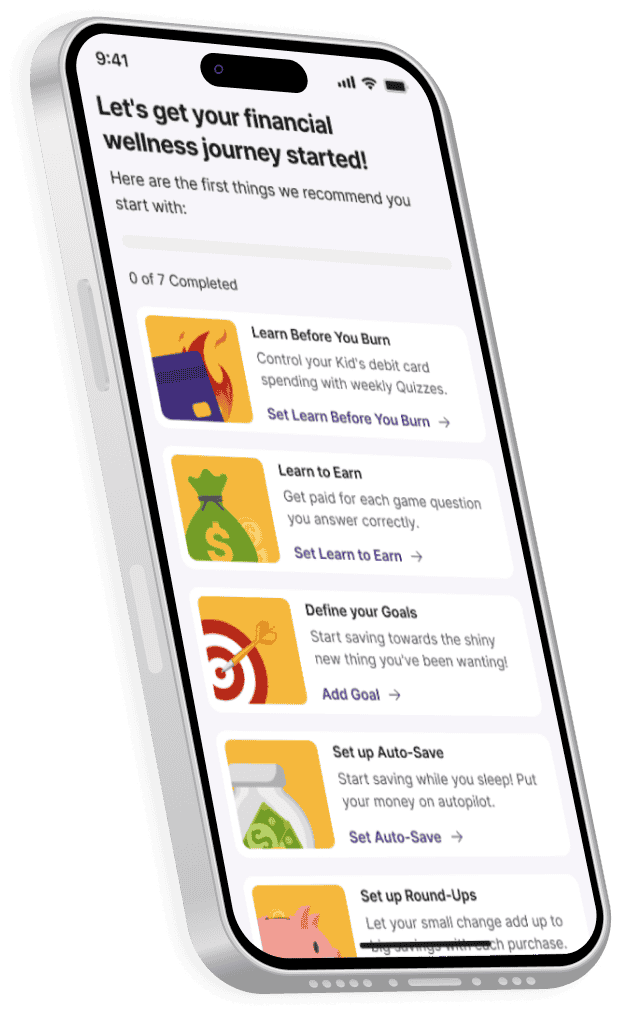

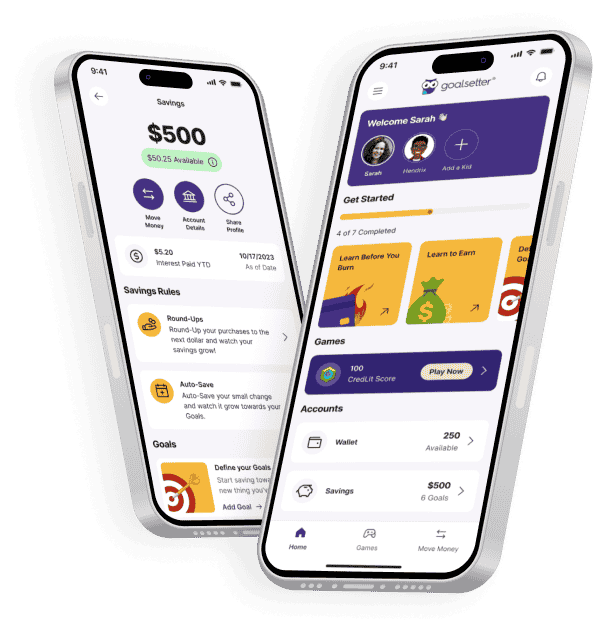

The White-Label Goalsetter App

Savings goals, allowance, expense tracking and parental controls helps kids become smart spenders, savvy savers, and earnest earners.

Co-Branded Kids & Teens Debit Card2

Not your typical debit card, Goalsetter lets parents reward kids for both earning and learning.

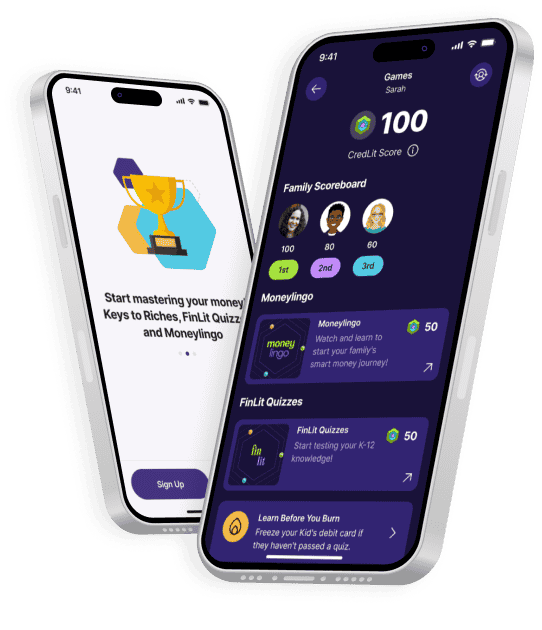

Engaging Financial Education

Goalsetter's one-of-a-kind suite of family finance videos help you deepen your relationship with your customers today, and tomorrow too.

Our Partners

Why Partner with Goalsetter?

When it comes to expanding your footprint and deepening your customer relationships, Goalsetter offers a comprehensive solution like no other.

Cultivate Next Gen Customers

Reach the next generation before they reach 18, cementing your relationship now and in the future.

Deepen Customer Relationships

Provide family finance education in a fun and engaging way, with 92% of families surveyed saying that they prefer learning financial education with Goalsetter.

Asset Growth and Retention

Acquire and retain deposits, because your deposits belong at your institution.

Offer Financial Education for Schools

Offering comprehensive middle and high school curriculum has improved students' financial aptitude by 47%, enabling them to achieve 83% mastery of key financial concepts.

91% of parents want

a youth bank account.

And 71% of those parents want it from their current financial institution.

Ready to Chat?

Get a tour of the Goalsetter Platform.