Goalsetter Classroom

Financial literacy that meets national and state standards, engages students, and transforms lives—inside and outside the classroom.

Our Curriculum

Unit 1

FINANCIAL PILLARS

- Earning Income

- Saving

- Spending

- Investing

- Managing Credit

- Managing Risk

Unit 2

CORE COMPETENCIES

Beliefs

Students reflect on their current views about money and explore what shapes financial behaviors.

Gain Understanding of what influences individual spending habits and financial decisions

Knowledge

Students learn key financial concepts through stories and real-life examples, including how institutions and policies impact wealth.

They will learn the history, purpose, and processes of institution, instruments, processes and policies that impact and influence a person’s wealth

Goals

Students set meaningful financial goals and track their progress while considering their impact on others.

They self-monitor and measure process towards goals throughout each session.

Habits

Students apply what they’ve learned to build lasting money habits, using the Goalsetter app to save and spend wisely.

Utilize Goalsetter app to establish healthy saving and spending habits

Unit 3

THE FINANCE 5 Cs

Connections

Context

Case Studies

Community

Commitment

Inspire students to set actionable financial goals, own their futures, and create lasting impact

Unit 4

STANDARDS CROSSWALK

- Earning Income

- Saving

- Spending

- Investing

- Managing Credit

- Managing Risk

Our Approach

Setting clear goals is essential to financial wellness.

"

Goalsetter Classroom provided our educators with the knowledge and tools to confidently deliver impactful financial education. It's making a tangible difference.

"

What Teachers Are Saying

“Teaching my students financial education shifts their focus to long-term planning, encourages financial responsibility, and builds a healthy mindset around money—equipping them to make informed choices and navigate their financial futures.”

Ms. Penny

“Goalsetter equips our students with lifelong learning in their financial decision-making and wealth management journey.”

Adam

Comprehensive Professional Learning and Development

We equip educators with the tools and training they need to confidently teach personal finance. Our certified team offers virtual and in-person sessions, plus ongoing support to help teachers bring Goalsetter Classroom to life in a meaningful way.

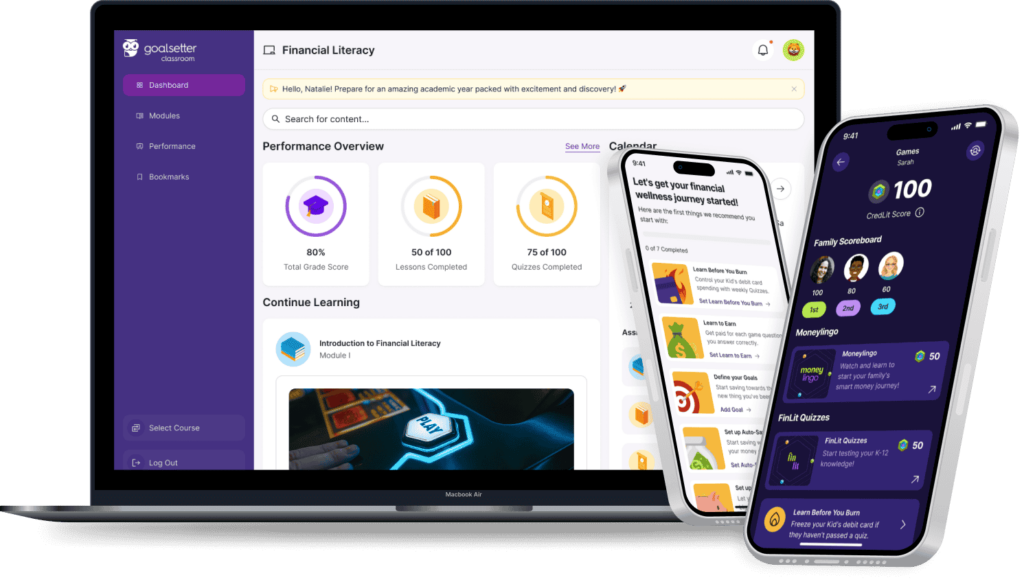

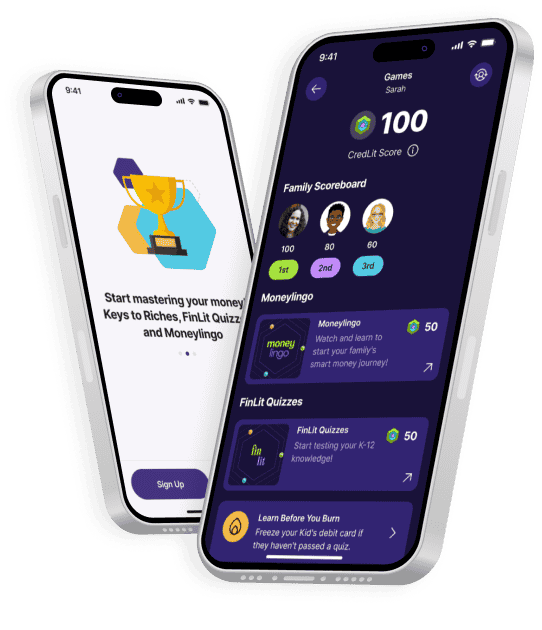

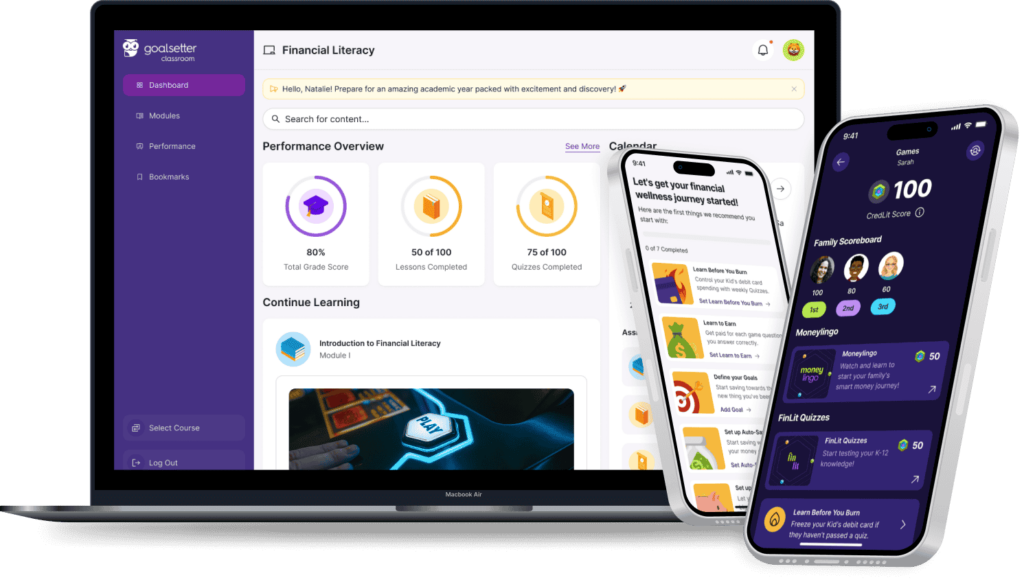

Interactive & Gamified Student Experience

Gamified quizzes, engaging videos, and interactive content

- Extensive video library that resonates culturally with diverse learners

- Interactive quizzes that gamify and reinforce key concepts

- Engaging platform features designed to boost motivation and retention

Robust Analytics & Dashboards

Powerful analytics tools to measure and improve student success

- Detailed dashboards of student progress and mastery

- Auto-grading and robust reporting for simplified classroom management

- Data-driven insights to inform instruction and improve outcomes

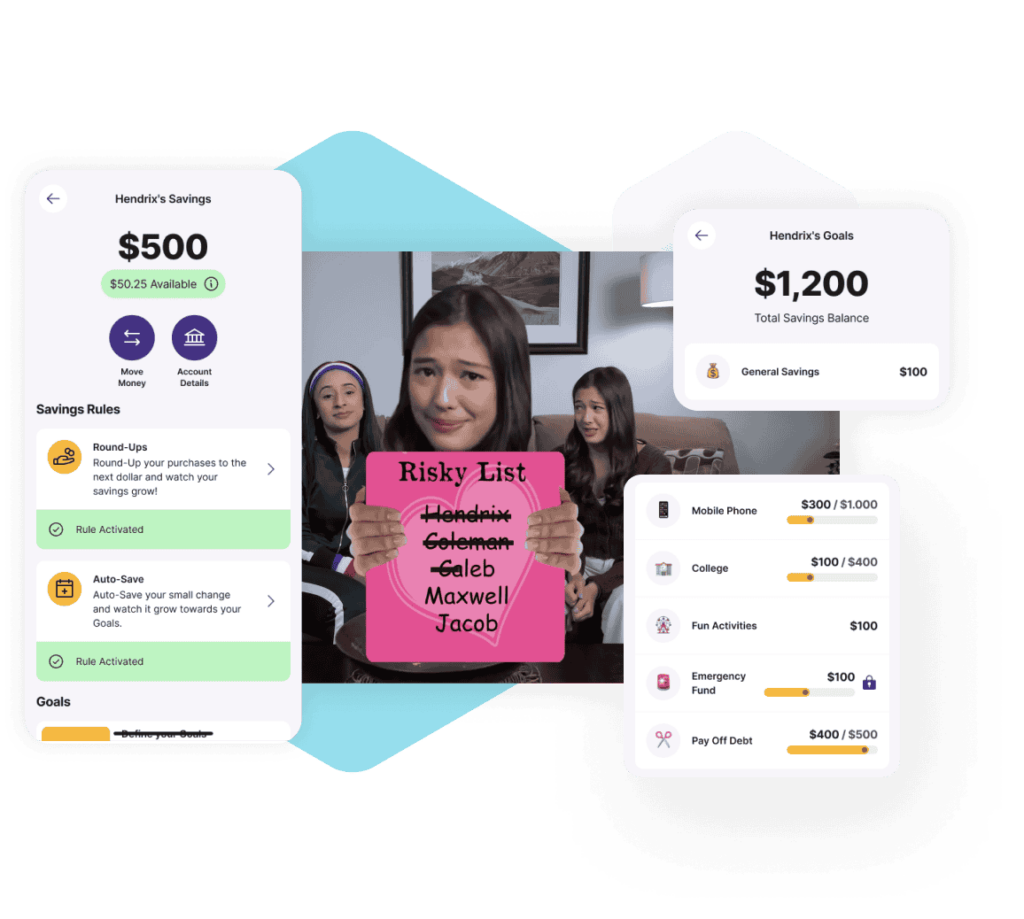

From Classroom Theory to Real-World Practice

Students apply the skills and strategies they’ve learned.

The Goalsetter App allows students to continue exploring financial topics with their families at home while also taking advantage of the savings account, debit card, and weekly financial educational quizzes, all mapped to K-12 national standards.

Success Metrics

Goalsetter Classroom FAQs

...

Goalsetter can provide its personal finance curriculum, Goalsetter Classroom, along with the Goalsetter App to schools by either direct or sponsored partnership.

To start, you’ll meet with the Goalsetter team to outline your needs and develop an appropriate program model that ensures your goals are met. Contact the Goalsetter team to begin this process and bring Goalsetter’s resources into your school today.

Bring Goalsetter Classroom to Your Organization

Discover how our engaging lessons and quizzes can level up financial literacy in your organization—sign up for a quick tour now!