MoneyLingo™ for Colleges

Where Campus Energy Meets Financial Fluency

Moneylingo™ makes learning about money fun, engaging, and life changing.

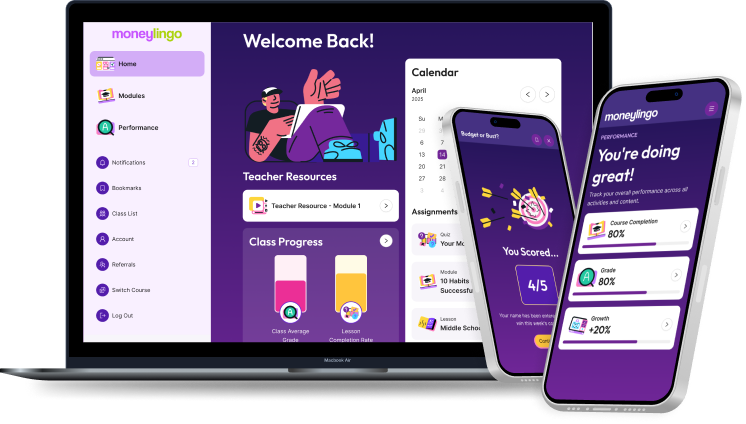

Meet Moneylingo

- A mobile-first financial education experience

- Game-based learning turns dense topics into easy learning

- Short, fun, and designed for consistent engagement.

- Covers earning, saving, spending, investing, credit, and risk

Mobile Money Lessons for Life.

Whether new to campus or navigating a new NIL deal, students can use Moneylingo for short, sharp, financial lessons delivered right to the palm of their hand.

Undergraduate Students

College means real financial independence. Moneylingo delivers bite-sized lessons on budgeting, credit, investing, and debt—helping students build smart habits and graduate financially confident.

Student Athletes

and NIL Talent

NIL creates opportunity and risk. Moneylingo teaches student athletes contracts, taxes, investing, and income management—turning today’s earnings into long-term financial security.

Business Programs

Students master corporate finance but not personal money. Moneylingo connects budgeting, investing, credit, and risk to real life, building financially confident leaders.

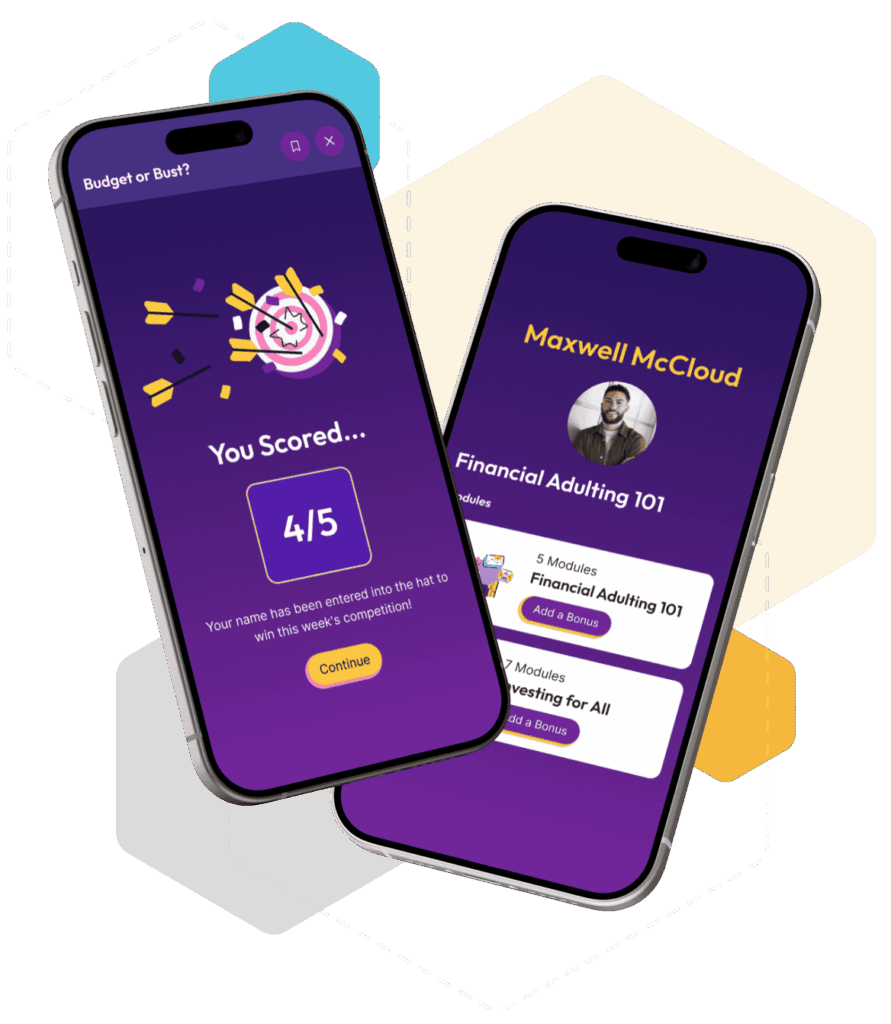

Complete Modules,

Win Tuition Prizes

Start a “Campus Compe-Tuition” where students earn entries to win tuition prizes by completing financial education modules.

The Ultimate “Learn to Earn” Experience.

Moneylingo Lessons

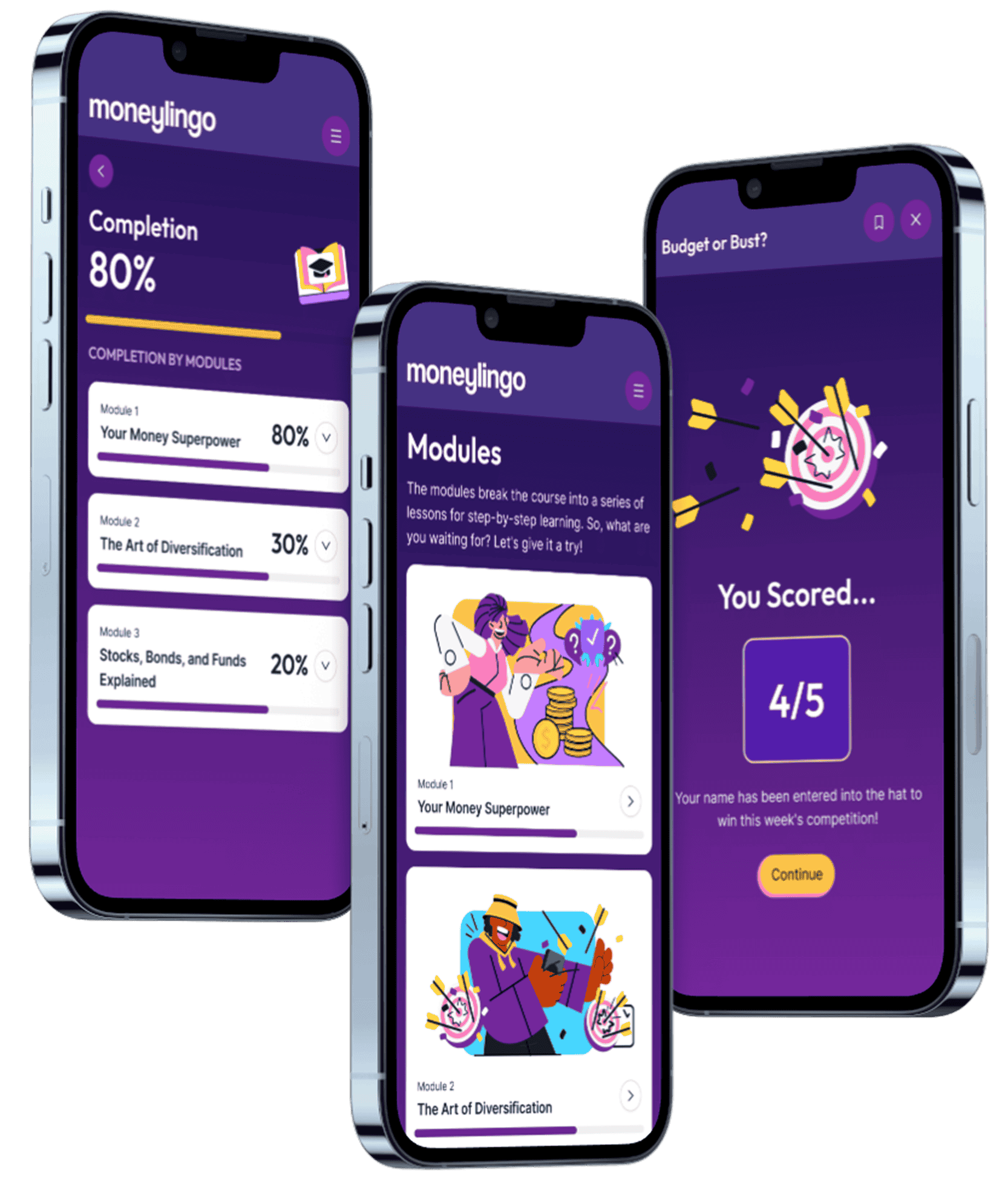

Developed by expert educators and financial professionals, Moneylingo delivers an innovative, digital curriculum that brings personal finance to life.

Our curriculum is aligned with national and state financial literacy standards and covers earning, spending, saving, investing, managing credit, and managing risk.

Students build a real-world understanding of how money works with topics covering earning, spending, saving, and planning, so they can make confident choices instead of guessing. Lessons connect everyday decisions to long-term outcomes through relatable scenarios and practical tools.

Goalsetter makes saving feel achievable by teaching students how to save consistently, set meaningful goals, and understand tradeoffs behind purchases. Interactive challenges help learners build habits and track progress over time.

Students learn investing fundamentals such as ownership, diversification, ETFs, and compound growth in a way that is clear and grounded. Gamified simulations reinforce patience, strategy, and long-term thinking without hype.

Students learn how credit cards, loans, interest, and credit scores work, and how borrowing decisions affect future options. Real-world examples help students understand both the benefits and the costs before taking on debt.

Students learn how emergency funds, insurance, and planning can reduce the impact of unexpected financial setbacks. Scenario-based lessons show how preparation improves outcomes when life changes fast.

From Learning to Action

Moneylingo bridges the gap between theory and life. Students gain not only knowledge, but the confidence to put it into action.

4/5

The Student's Path

1.

Complete fun, interactive MoneyLingo learning modules

2.

Earn prizes, and tuition sweepstakes entries through the Campus Compe-Tuition.

3.

Walk away financially fluent — and ready for what’s next.

Real people.

Real Impact.

Goalsetter drives measurable knowledge gains and measurable outcomes too.

Because financial education only matters if it works.

Moneylingo is reshaping how colleges teach financial literacy...

We’ll help you launch in under 30 days.